Industry Scan

By Jonathan Ray | September 1, 2008

Send Feedback

With EDO Purchase ITT Is Poised For Bigger Piece Of EW Market

ITT Corp. foresees double-digit annual growth of its Electronic Systems group, helped by the recent addition of the former EDO Corp. The market for electronic warfare (EW) systems is seen as a major driver of that growth.

The acquisition of EDO, valued at $1.7 billion, was concluded last December. It represented ITT’s largest acquisition since ITT Industries (now Corp.) was formed as an independent company in 1995. It also made ITT a top-10 U.S. defense contractor in terms of revenue. The company’s Defense Electronics & Services business, based in McLean, Va., generated $4.2 billion in 2007; it is expected to finish at $6.1 billion this year.

EDO, a multi-faceted manufacturer of electronic subassemblies for military and space applications, advanced composite structures, sonar systems and test equipment, came with an 80-year legacy and positions on a range of strike, EW and surveillance aircraft. ITT bought EDO not to absorb it, company officials say, but to expand ITT’s own offerings.

"ITT went ahead with this purchase with the idea that it was going to be a true merger/integration," said Christopher M. Carlson, director of U.S. business development for ITT Electronic Systems. "We were not looking to buy and consolidate. We saw in EDO, what they were doing, a lot of complimentary technologies and markets."

In an interview during the Farnborough Airshow in July, Carlson made the case that EDO and ITT combined are more capable than the sum of their parts. The expectation going forward, he said, is ITT’s $1.29 billion Electronic Systems group will grow by 10 percent annually.

One springboard for the merged company is the new EA-18G Growler, the U.S. Navy’s replacement for the 40-year-old EA-6B Prowler EW aircraft. EDO’s Defense Systems unit in North Amityville, N.Y., supplied components of the AN/ALQ-99 jamming system of the EA-6B, which is comprised of receivers and antennas in the aircraft’s tail cap and exciters, which optimize jamming signals, and transmitters contained in pods under the wings and fuselage. The Universal Exciter Upgrade extended the system’s frequency coverage and incorporated advanced jamming techniques and modulations.

Like the EA-6B, the Growler is fitted with ALQ-99 transmitter pods as well as an Interference Cancellation System (INCANS) from the former EDO facility at Thousand Oaks, Calif., now part of the ITT family.

"With us picking up Amityville, one of the major markets going forward is the electronic attack market," Carlson said. "The current Navy system supporting both the Navy and the Air Force — the EA-6B — is being phased out in favor of the [EA-18G]. The Air Force doesn’t have a replacement for it, so both the Navy and the Air Force are looking at new equipment. For the EW world, that’s going to be one of the major markets, at least domestically in the U.S., in the next decade."

The Navy is planning a next-generation jammer for the EA-18. Meanwhile, the Air Force Research Laboratory has awarded contracts to companies including ITT to mature technology for an EW pod that would be flown on the B-52 bomber, replacing the cancelled Stand-Off Jammer System for that aircraft. ITT has contracts to develop exciter and phased-array jamming technologies at lower frequencies.

With the former EDO’s contribution, ITT is better positioned to offer an EW system solution, Carlson said.

"The old EDO group already had a position on the EA-6B with their Universal Exciter," Carlson said. "ITT in Clifton (N.J.) had been working on the… transmit side, with a number of contracts from the Air Force to develop new phased-array technology. Now, we find with the merger, that we have the complete story. We’ve got the waveform generation with the exciter coming out of (Amityville); we have the new-technology transmitters and beam formers coming out of New Jersey. You put the two together [and] ITT has a complete system."

Forecast International estimates $23 billion will be spent on development and production of major EW programs over the next 10 years — driven by the need to counter improvised explosive devices, to adapt airborne EW systems and potentially to protect civilian airliners from missiles. Frost & Sullivan has pegged the U.S. market for EW programs at $1.25 billion in 2008, growing to $1.31 billion in 2013. The market leaders across reports include Northrop Grumman, ITT, Raytheon, BAE Systems, Lockheed Martin and Thales.

One technology that Carlson does not see as raining on this parade is the use of Active Electronically Scanned Array (AESA) radar for electronic attack. That application is being studied by, among others, Northrop Grumman, which supplies AESA radars for the F-22 and F-35 multirole fifth-generation fighters.

"The problem, or the issue, in electronic attack is you want to attack the radars that span the entire frequency range," Carlson said. "When people talk about using the AESA radar as also an electronic attack device — of the whole range, that covers a small [amount]. Although the radars that they’re putting in the modern airplanes are broader bandwidth than a generation ago, instead of a tiny sliver of the frequency range, they’ve now got a small niche of it."

ITT at Farnborough had other developments to report — the first international sale of its ALQ-214 Integrated Defensive Electronics Countermeasures system as part of Australia’s procurement of 24 F/A-18E/F fighters; and Turkey’s selection of the ALQ-211(V) 4 EW suite for new F-16s, joining Pakistan, Poland, Chile and Oman. Pakistan also was expected to order the (V) 9 podded version of the system to equip older F-16s under a Foreign Military Sale. The company’s ALQ-211 (V) 2 for the U.S. Air Force CV-22 tiltrotor and (V) 6 for the U.S. Army Special Operations MH-47E Chinook have entered full-rate production.

"This is the fourth or fifth good year we’ve had in a row," Carlson said. "We feel good, with the 211 and 214 in full-rate production, new technology with electronic attack and new capabilities [such as] test equipment in California, through the EDO purchase. The new group in (Amityville) is heavily involved in the electronic attack market and is going to enhance our position in the market." — Bill Carey

Unmanned Systems

Boeing Acquisition

Looking to gain a stronger foothold in the unmanned air systems (UAS) market, Boeing in July announced plans to acquire Insitu, Bingen, Wash., a UAS developer. Terms of the transaction, expected to close in September, were not disclosed.

Boeing and Insitu have partnered since 2002 and jointly developed the ScanEagle and Integrator UAS programs. Once acquired, Insitu will be a separate subsidiary under Boeing Integrated Defense Systems’ Military Aircraft unit. Insitu has 360 employees and anticipates revenue this year of $150 million.

"This acquisition is part of a larger plan to aggressively grow our presence in the unmanned systems market," said Chris Chadwick, president, Boeing Military Aircraft. "We look forward to building upon our existing relationship with Insitu to deliver industry-leading tactical unmanned systems and services to our customers."

MAV Marketing

Honeywell signed an agreement with Thales to market the Honeywell Micro Air Vehicle (MAV) to military organizations in France, Germany and the United Kingdom. According to the agreement, announced at the Farnborough Airshow in July, Thales will offer the MAV as a stand-alone UAV or as part of larger military programs.

Propelled by a ducted fan, the MAV weighs 16 pounds and measures 13 inches in diameter. Equipped with EO and IR sensors, it operates at altitudes of more than 10,000 feet, with 50 minutes endurance. It has been field-tested in Iraq and has flown more than 3,500 test flights over the past three years, Honeywell said.

"Honeywell’s Micro Air Vehicle has demonstrated versatility in the field and the value of the real-time surveillance data it provides," said Mike Cuff, Honeywell vice president for helicopters.

PicoSAR Flight

Selex Galileo and its partner, Schiebel Elektronische Geraete GmbH, reported the first flight of a Schiebel Camcopter S-100 equipped with PicoSAR (Synthetic Aperture Radar). The radar gives the unmanned aircraft an all weather, long-range ground mapping and moving target indication capability.

The PicoSAR was flight tested June 30 near the Schiebel facility in Wiener Neustadt, Austria. The rotary-wing Camcopter S-100 operated at altitudes up to 3,000 feet; the PicoSAR was controlled via datalink from the ground with imagery sent to a ground station. "UAVs are here to stay and adding sensors like PicoSAR will vastly increase their utility," said Norman Bone, senior vice president radar and advanced targeting, Selex Galileo.

In May, Boeing and ImSAR demonstrated real-time processing of SAR data from a ScanEagle unmanned aircraft equipped with ImSAR’s NanoSAR radar.

VADER Tested

Northrop Grumman in July said it completed the first test flight of its Vehicle and Dismount Exploitation Radar (VADER), a sensor system being developed for use with the Sky Warrior UAV built by General Atomics Aeronautical Systems.

The VADER is being developed under a contract with the U.S. Defense Advanced Research Projects Agency. Awarded in 2006, the objective of the VADER program was to design, build and test a radar system within two years.

During the flight, conducted in Georgetown, Md., high-resolution Synthetic Aperture Radar (SAR) imagery and Ground Moving Target Indicator (GMTI) data were collected on a Northrop Grumman PBN Islander test aircraft and processed at a ground station to show vehicle motion on the ground. When deployed, VADER will provide accurate GMTI data and SAR imagery to ground commanders in real time, Northrop Grumman said.

Counter UAV

General Dynamics Armament and Technical Products, Charlotte, N.C., conducted a demonstration of its ground-based, Counter Man-Portable Airspace Protection System (CMAPS) against multiple UAVs at the Naval Air Systems Command test facility in China Lake, Calif.

CMAPS detected, tracked and destroyed various UAVs by targeting critical aircraft components during the test, the company said. The portable, rapidly deployable system uses a network of sensors to detect and track a threat. Once the threat is identified, infrared countermeasures are directed to the target.

Military

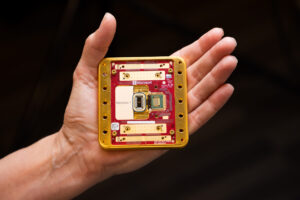

FCS Switch Module

Curtiss-Wright Corp. in July won a $4.25 million contract for the development and demonstration phase of the U.S. Army’s Future Combat Systems’ (FCS) Integrated Computer System.

Under terms of the contract with General Dynamics C4 Systems and Rockwell Collins, Curtiss-Wright will supply its Gigabit Ethernet Switch Module (GESM) to meet the performance and reliability needs of the FCS, a family of networked air- and ground-based systems.

Curtiss-Wright will supply a rugged VPX-based line replaceable module, VPX3-683. The module supports "in-the-field" servicing, enabling the replacement of individual cards rather than entire subsystems, reducing cost, complexity and logistics.

General Dynamics and Rockwell Collins are providing computer processing, networking, information assurance and data storage resources necessary to support FCS network-centric operations.

C-130J Avionics

GE Aviation was selected by Lockheed Martin to supply open-system avionics for the C-130J Hercules update. The contract, addressing Block 7 development for 230 aircraft, is valued at more than $30 million over the life of the program.

GE will supply a compute platform with an AE653 partitioned operating system, supporting the Block 7 communications/navigation/identification system. The platform hosts GE’s flight management software application as well as other software. GE also will provide systems and sub-systems integration and support to the U.S. Air Force.

Production is set to begin in 2010.

Apache Block III

Boeing celebrated the first flight of its AH-64D Apache Block III in July in Mesa, Ariz. Prior to a ceremony at Boeing’s production facility, the aircraft was flown by U.S. Army Vice Chief of Staff Gen. Richard Cody and Chief Warrant Officer 5 Rucie Moore, an experimental test pilot.

The Block III will have upgraded computers, networked sensors and mission avionics. The Army awarded Boeing the first Apache Block III contract in 2005. Boeing plans to begin initial production in 2010 and to deliver the first production AH-64D Apache Block III in 2011.

ASTOR Tests

Raytheon and the U.K. Ministry of Defense completed capabilities assurance mission (CAM) testing of the Airborne Stand-Off Radar (ASTOR) system.

A team from Raytheon and the U.K. Royal Air Force 5 Squadron conducted six CAM tests to demonstrate how the system would work in a mission scenario.

ASTOR is an advanced air-ground surveillance system which will be jointly operated by the RAF and the British Army. It uses the Bombardier Global Express business jet, known in service as the Sentinel R Mk 1, and an Active Electronically Scanned Array radar.

‘Mantis’ Program Unveiled At Farnborough

BAE Systems and the U.K. Ministry of Defense entered the first phase of a jointly funded program to develop a large unmanned autonomous system (UAS) for future operational needs. The Mantis UAS Advanced Concept Technology Demonstrator program, unveiled at the Farnborough Airshow, involves BAE, the MoD and industrial partners including Rolls-Royce, QinetiQ, GE Aviation, Selex Galileo and Meggitt.

BAE said the design and manufacture of the twin-engine Mantis and the associated ground control infrastructure was underway. Assembly, vehicle ground testing and infrastructure integration testing will take place later this year, with first flight scheduled for 2009.

"Mantis is an Advanced Concept Technology Demonstrator that will provide an opportunity to exploit emerging technologies, capabilities and systems," said Air Vice Marshal Simon Bollom. "Its rapid development will provide indicators of how we can improve the acquisition process to deliver capability swiftly into fast changing military environments. A development program such as Mantis will also help maintain U.K. indigenous capabilities in this fast evolving area."

Mantis will benefit from low-cost advanced construction techniques developed on earlier BAE Systems UAS programs, provide for "plug and play" systems and equipment, and enable flexible external stores carriage. It will have a triplex flight control system, "with full exploitation of onboard autonomy reducing operator workload and increasing system performance."

Sukhoi Su-35 A ‘Transfer Model’ To Russian 5th Generation Fighter

With the development of a fifth-generation fighter remaining a "top priority," Russia’s Sukhoi Co. in July described its gap-filler Su-35 multi-role fighter, which first flew Feb. 19.

Fitted with a glass cockpit, information management system and advanced, multi-mode phased array radar, the Su-27 Flanker derivative is being readied for both the Russian air force and the export market. Addressing a Farnborough Airshow press briefing July 14, Mikhail A. Pogosyan, Sukhoi Holding director general, said Sukhoi sees a potential world market for 200 Su-35s. Candidate countries are seen in South America, southeast Asia, Africa and the Middle East.

The "4++" generation aircraft, slated for serial production in 2011, will serve as the "transfer model" to a fifth-generation fighter, said Pogosyan, speaking through a translator. The latter, PAK-FA, program is expected to be a 7- to 10-year effort that is a "top priority [and] on schedule," he said. Pogosyan was quoted in airshow press reports as saying a T-50 prototype would fly late next year, with production beginning in 2015.

The first prototype of the Su-35 was demonstrated July 7 at the M.M. Gromov Flight Research Institute in Zhukovsky, outside Moscow, to Russian Ministry of Defense and air force officials as well as foreign diplomats and journalists, Sukhoi said. But the aircraft was not available for the trip to Farnborough, which instead was treated to a dramatic flight display of Lockheed Martin’s fifth-generation F-22 Raptor.

Two more Su-35 prototypes were being assembled by the Komsomolsk-on-Amur Aviation Production Association (KnAAPO) and were expected to be rolled out this year. A fourth prototype is planned as a production standard aircraft. The fighter is powered by "substantially modified" AL-31F engines with increased thrust and a vectored thrust nozzle.

At the core of the Su-35 avionics is an information management system that integrates "functional, logical, informational and software subsystems into a single complex," Sukhoi said. The aircraft is fitted with an Irbis-E X-band, multi-role radar with a passive, phased antenna array mounted on a two-step hydraulic drive unit, in azimuth and roll. The Irbis-E radar, developed by the Tikhomirov Scientific-Research Institute of Instrument Design (NIIP), detects and tracks up to 30 air targets, engaging up to eight. The radar detects, chooses and tracks up to four ground targets in several map-making modes with various resolution at a range of up to 400 km, Sukhoi said.

The Su-35 and Superjet 100 regional airliner are key projects as Sukhoi transitions from a primarily military aircraft manufacturer to a more diversified company, Pogosyan said. The Superjet first flew May 19, and type certification to Western standards is expected in mid-2009. Sukhoi and partner Alenia Aeronautica announced orders for 25 Superjet 100s at Farnborough — the first to European customers outside Russia — bringing total orders to 122.

"We are changing the perception of the company in the world’s eyes," Pogosyan said. "…If you want to be a global player, you can’t concentrate solely on the military." – Bill Carey

Business/GA

Synthetic Vision

Avidyne Corp. and L-3 Avionics Systems unveiled new synthetic vision offerings in separate announcements at EAA AirVenture in Oshkosh, Wis., in late July.

Avidyne, Lincoln, Mass., introduced both synthetic vision (SVS) and enhanced vision (EVS) additions to its Entegra integrated flight deck. The Entegra SVS improves on existing systems by depicting 3-D terrain out to the horizon, based on the aircraft’s altitude above the ground.

The system also depicts obstacles, traffic and "Highway-in-the-Sky" (HITS) boxes on the primary flight display. Entegra EVS uses a Max-Viz EVS-100 infrared camera, enabling pilots to see further in marginal VFR conditions through most atmospheric obscurations, Avidyne said.

L-3 Avionics Systems, Grand Rapids, Mich., added synthetic vision to its SmartDeck Integrated Flight Controls and Display System. The SVS uses GPS location and altitude data in conjunction with SmartDeck’s terrain database to depict realistic-looking, 3-D images of land, mountains, obstacles, water and runways on the primary flight display.

The image moves in real time with the aircraft, and presents a clear view of the outside environment, beneficial during limited visibility conditions, L-3 said.

Synthetic vision will be available as an option on new SmartDeck systems or as an add-on for existing models after certification, expected later this year.

In another recent announcement, Chelton Flight Systems, Mineral Wells, Texas, said it received European Aviation Safety Agency certification for its Electronic Flight Instrument System with SVS for use on the Bell 407 and 206A, B and L-series light single-engine helicopters.

The Chelton SVS uses 3-D graphics to translate the terrain ahead and around the helicopter into a real-time picture. The system includes HITS capability, allowing pilots to fly with ILS precision to any point, and Helicopter TAWS, providing visual and audio clues when terrain or obstacles present a hazard. Chelton said its newest software package, version 6.0B, will be installed on the system.

Chelton Relocation

As a result of the merger of Chelton Flight Systems and S-TEC this year, Chelton relocated from Boise, Idaho, to S-TEC’s Mineral Wells, Texas, facility, effective Aug. 1.

Cobham plc, the parent company of Chelton Flight Systems, in November 2007 reached agreement to acquire S-TEC Corp., from Meggitt plc for $38 million. Cobham said the subsequent merger of Chelton and S-TEC was part of its drive "to develop a fully integrated cockpit."

S-TEC operates out of a 10-acre engineering and production campus at the Mineral Wells Municipal Airport. A 57,000-square-foot facility has a administration, engineering and manufacturing plant and a 28,000-square-foot hangar, which houses flight operations.

HondaJet Selection

The Power Data Systems Group of AMETEK Aerospace Defense, Wilmington, Mass., was selected by Honda Aircraft Co. to supply Primary Power Distribution and Integrated Generator Control functions on the new HondaJet business aircraft.

Also, AMETEK was selected to supply circuit breaker panels and Interior Cabin Load Control using its Amphion Solid-State Power Controller. HondaJet’s Primary Power Distribution System distributes DC electrical power from AMETEK’s 325A DC Starter Generators, combining communications, control and load monitoring features through an ARINC 429 databus to the avionics suite.

HondaJet is scheduled for first deliveries in the United States in 2010.

Commercial

Emirates A380 Makes Inaugural Flight To U.S.

Emirates Airline, the second airline to receive an Airbus A380, operated the first commercial flight of the aircraft to the United States Aug. 1. Aboard for the 13-hour trip from Dubai to John F. Kennedy International Airport were 489 passengers, two infants and 24 cabin crew.

"It handles pretty good. It’s very stable, powerful, responsive. In summary, it’s great to fly," said Emirates A380 Chief Pilot Abbas Shaban, who spoke at a reception ceremony in the Emirates lounge. Shaban’s co-pilot on the first commercial flight was Capt. Patrick De Roeck.

The Dubai flag carrier will operate the A380 three times a week on the New York-Dubai route. It currently has twice-daily service to New York.

The Port Authority of New York and New Jersey, which operates JFK, started preparing for the arrival of the jumbo jetliner in 2004, with a $179 million airport improvement program. Among infrastructure modifications, the airport strengthened four taxiway bridges and runway pavement to accommodate heavier aircraft and relocated a taxiway to allow wider-body maneuvering. "The board authorized this program because we recognized the pivotal role of aircraft like the A380 in adding much-needed aviation capacity in our region," said Anthony R. Coscia, chairman of the Port Authority. Over the past four years, the number of annual passengers at JFK has increased by 43 percent to 48.2 million, according to the authority.

With 58 A380s on firm order at a cost of $19 billion, Emirates is by far the aircraft’s largest customer. The airline is due to receive five A380s in the current fiscal year ending March 31, with the remaining 53 delivered by June 2013.

Launch customer Singapore Airlines, which has ordered 19 A380s with options for six more, took delivery of its first aircraft from Airbus in October 2007 and was operating five A380s as of August.

"A lot of people ask us, where are you going to fly these airplanes, why did you buy so many of them, how are you going to fill them?" related Emirates President Tim Clark, who made the trip from Dubai and then fielded questions at the reception ceremony. "… These A380s, of which we have 58 on order, will soon be flying over the next three to five years, and they will all be full. And if the truth be known, Emirates really does need a lot more than this."

Clark said the airline’s passenger seat factor was "pushing 84 percent" in the week prior, at a time when Emirates had grown its seating capacity by 20 percent over the same time last year. "The income of the company, the operation of the airline, the deployment of the assets, the number of people we’re carrying is working very, very well," he assured. "We are being hit hard by fuel, but then so is everybody else."

He was asked if government-owned Emirates is subsidized for fuel costs. "I’m surprised you asked that question, because we’ve made it absolutely clear from Day 1 that we receive no subsidies whatsoever," Clark said.

"… We don’t get it in fuel, we don’t get it in landing fees, we don’t get it in banking. We don’t get free cash. We have to pay for these airplanes as much as everybody else. We have to generate that cash ourselves or go into the international financing community for debt provision, and that’s what we’re doing." — Bill Carey

CSeries Launched

Bombardier announced the launch of its CSeries jetliners at the Farnborough Airshow in July, aiming to capture up to 50 percent of the 100- to 149-seat category at the lower end of the airliner market.

Years under consideration, the CSeries program was scaled back for a year between 2006 and 2007, leading some to conclude it was cancelled. At Farnborough, Bombardier said it had a "letter of interest" from Lufthansa for up to 60 aircraft, including 30 options. The aircraft is slated to enter service in 2013 ( Avionics, May 2008, page 26).

Rockwell Collins will provide its Pro Line Fusion integrated avionics suite for the CSeries. This will include 15-inch LCDs capable of enhanced and synthetic vision and flight management system with WAAS/LPV and RNP SAAAR capabilities. The aircraft will be powered by the new Pratt & Whitney Geared Turbofan engine and will make increased use of composites and aluminium lithium in structures. Other named suppliers are Parker-Hannifin Corp., fuel and hydraulics systems; Liebherr-Aerospace Toulouse SAS, Air Management System, including environmental control and cabin pressure control system; and C&D Zodiac, the aircraft’s interior, including seats, and oxygen, lighting, insulation, waste and water systems.

Bombardier estimates the 100- to 149-seat commercial aircraft market to be 6,300 aircraft representing more than $250 billion in revenue over the next 20 years. The CSeries 110- and 130-passenger airliners, also planned for extended-range versions, will compare in size to the Airbus A318 and A319 and certain Boeing 737s.

Scott E. Carson, president and CEO of Boeing Commercial Airplanes, downplayed the announcement at Farnborough. The CSeries "is a long ways away, and we’re sold out a long ways forward on the 737," he said. "We’re not anticipating any significant implications from that."

RTCA Leadership

Longtime RTCA President David Watrous was to retire from the position at the end of August, according to a memo obtained by Avionics. He will be succeeded by Margaret T. Jenny, a former ARINC and MITRE Corp. executive who headed an aviation consulting firm, MJF Strategies LLC, McLean, Va.

Organized in 1935 as the Radio Technical Commission for Aeronautics, RTCA develops consensus-based recommendations that are used by FAA as the basis for policy, program and regulatory decisions, and by industry from technical and program guidance. It is a not-for-profit corporation that relies on special committees of industry and government volunteers.

Watrous, a former career officer in the U.S. Air Force, came to RTCA in 1989 and has served as its president since 1991.

"I’ve truly enjoyed my time at RTCA," Watrous said in the memo. "There have been many exciting challenges, opportunities and accomplishments over nearly two decades. Operationally, RTCA has helped modernize the air traffic control system in almost every dimension. From a business perspective, we’ve nearly quadrupled membership and significantly improved the financial posture of the organization."

Prior to MJF Strategies, Jenny was vice president of corporate business development at ARINC. From 1996 to 1999, she led operations research and analysis for US Airways.

From 1983 to 1996, Jenny directed future concepts and analysis at MITRE’s Center for Advanced Aviation System Development, as well as international aviation programs. She was also a member of RTCA’s Free Flight Select Committee.

A350 Packages

Airbus selected SAFRAN Group company Sagem Défense Sécurité to supply the flight data acquisition and security system for the new A350 XWB. Rockwell Collins was chosen to supply information management and navigation systems, adding to earlier awards.

The Sagem system will consist of two components: a Centralized Data Acquisition Unit (CDAU), which acquires, processes, monitors, displays and records data available on the aircraft in order to monitor systems and facilitate maintenance and flight safety; and a Secure Communication Interface, providing the secure link between the avionics core and the open information. Also, SAFRAN Group companies Messier-Dowty and Messier-Bugatti were selected for the A350 main landing gear and landing and braking control systems, respectively.

Rockwell Collins will provide its "Information Management Onboard" system, a hosting platform for flight operations, aircraft maintenance and airline applications. It includes a standard Class 2 electronic flight bag interface. Rockwell Collins will provide the hardware, system software and system integration. Also, Rockwell Collins will provide navigation system components, including the ADF-900 Automatic Direction Finder, DME-2100 Distance Measuring Equipment and VOR-900 VHF Omnidirectional Radio receiver.

Rockwell Collins earlier was selected to provide the A350 integrated Communication Global Work package, Avionics Data Network, Landing Guidance Systems and Trimmable Horizontal Stabilizer Actuator. The company estimates the potential value of the program to be $2.5 billion.

DIANA Project

Embedded software provider SYSGO said its PikeOS virtualization platform was selected to support the ARINC 653 test application ported on AIDA, the new platform defined by the European DIANA project. The test application is a Flight Management System.

DIANA, which stands for Distributed, equipment Independent environment for Advanced avioNics Applications, is an avionics R&D project funded by the European Commission’s 6th Framework Program and led by Skysoft, of Portugal.

The purpose is to define an advanced platform, called AIDA (Architecture for Independent Distributed Avionics), supporting execution of object-oriented applications over virtual machines and secure distribution services. Main parts of the application will be hosted on a PC running PikeOS. Smaller test applications such as redundant components and sensors will be hosted using light-weight simulators on other PCs, SYSGO said.

Members of the consortium are Skysoft; Alenia Aeronautica and Alenia SIA, of Italy; Aonix, of France; Budapest University of Technology; Dassault Aviation; Embraer; the Netherlands NLR national research laboratory, Thales and the University of Karlsruhe, Germany.

Contracts

Honeywell signed an $80 million contract with Airbus to upgrade the navigation wingtip lighting on A320s to LEDs. The lighting will be incorporated into the production line in 2009 for all forward-fit A320s. The 30-year contract covers about 5,000 forward-fit production and fielded aircraft in the A320 family including A318, A319, A320 and A321. It also covers the forward navigation lights located inside the wingtip.

CAE, Montreal, was awarded $49.7 million in contracts to manufacture four full-flight simulators and associated training devices for Etihad Airways (Boeing 777-300ER); British Airways (Airbus A320); Bombardier (Global Express); and Embraer (E170/190).

Boeing completed an upgrade to the first of five Saudi E-3 Airborne Warning and Control System aircraft as part of a $49.2 million contract to install Link 16 communications. Alsalam Aircraft Co. will upgrade the remaining four aircraft in Riyadh, Saudi Arabia. The upgrade is set to be complete in 2009.

The U.S. Army Communications and Electronics Command awarded a contract to Hamilton Sundstrand to supply Advanced Flight Control Computers for upgrade of Sikorsky UH-60A/L helicopters. The five-year agreement is expected to generate $45 million. Engineering and program management will be performed in Windsor Locks, Conn., with sub-assembly and final assembly in Phoenix.

BAE Systems was awarded a $32 million contract from the U.S. Navy to supply countermeasures for F/A-18 E/F Super Hornets. The AN/ALE-55 system consists of an onboard electronic frequency converter and the decoy. BAE will manufacture up to 650 decoys and more than 120 electronic frequency converters.

Vision Systems International, San Jose, Calif., was awarded a $17 million contract from Boeing for the Joint Helmet Mounted Cueing System in 145 F-15E Strike Eagles. Deliveries will continue into 2009.

ViaSat, Carlsbad, Calif., was awarded a $12 million contract from Lockheed Martin to manufacture a Communication, Navigation, and Identification Function Stimulator for avionics testing of the F-35 Lightning II. Delivery to Lockheed Martin is scheduled for 2010.

US Airways selected the Northrop Grumman LTN-101E Air Data Inertial Reference Unit for its new Airbus A320s and A330s. The unit uses fiber-optic gyros and MEMS silicon accelerometers, and integrates inertial and GPS measurements to provide aircraft position.

Southwest Airlines extended its avionics and mechanical products maintenance contract with Honeywell. The pact covers Southwest’s Boeing 737 fleet for the next 10 years. Honeywell will provide aftermarket services for its equipment including auxiliary power units, hydro mechanical units, avionics, lighting, mechanical components and wheels and brakes.

Barco was awarded a contract from Thales to supply Multipurpose Control Display Units for the Lockheed C-130H and Dassault Atlantique 2 fleets operated by the French Armed Forces. Thales will integrate more than 100 of Barco’s CDMS-3000 units into the C-130s used by the French air force and the Dassault Atlantique 2 patrol aircraft deployed by the French navy. Thales is outfitting the aircraft with its TopDeck avionics suite.

CMC Electronics and Raytheon Space and Airborne Systems signed a 12-year agreement for the supply of more than 35,000 hybrid microcircuits for Active Electronically Scanned Array radar systems for F-18E/F and F-15E aircraft.

CMC Electronics was selected by Lockheed Martin to provide its TacView Portable Mission Display for current and future C-130J mobile display system requirements. TacView also was selected by the U.S. Air Force Special Operations Command for its AC-130 gunships.

CMC Electronics has been selected by Lockheed Martin Aeronautics to supply a dual installation, civil certified GPS sensor on the C-130J Hercules.

Thales will install its TopSeries IFE system on seven ERJ 170 aircraft for ETA Star Group, of Dubai, with options for three more. The aircraft will be operated by the newly created Star Aviation Pvt Ltd., of Chennai, India. The carrier will take delivery of aircraft from March 2009 through February 2010. Thales also will install the TopSeries IFE system on 10 additional A330s for low-cost carrier AirAsia X of Malaysia. In total, the airline will have the Thales IFE system on 25 A330s, with deliveries from October through 2013.

Sensis, of Syracuse, N.Y., leads a team that will study the impact of new aircraft types on the Next Generation Air Transportation System. Under terms of a contract awarded by NASA in July, Sensis will use modeling and simulation to study the impact of emerging aircraft including supersonic transports and low-flying air vehicles on system performance, environmental efficiency and safety assurance. Sensis’ team includes Georgia Tech, CSSI, ATAC Corp., L-3 Communications, Honeywell and the Massachusetts Institute of Technology.

Liebherr Aerospace chose AMETEK Airscrew, part of AMETEK Aerospace & Defense, to supply modular aircraft heaters for the Sukhoi Superjet 100 and ARJ-21. Liebherr is providing environmental control systems for both.

Aircraft leasing company BOC Aviation, of Singapore, selected a baseline avionics package from Rockwell Collins to equip 47 new Airbus A320s. Deliveries will begin in the fourth quarter. Rockwell Collins will provide avionics including its WXR-2100 MultiScan Hazard Detection System.