The demand for smaller, lighter and more capable wire and cable to address growing data rate and power requirements on aircraft is catalyzing robust industry and university research and development programs. These efforts include initiatives to tap the potential of carbon nanotube (CNT) technology and design and deploy higher speed copper and fiber optic solutions. Even as steep budget cuts are being made, these efforts are expected to press on in laboratories, on test beds, and onboard aircraft.

The demand for smaller, lighter and more capable wire and cable to address growing data rate and power requirements on aircraft is catalyzing robust industry and university research and development programs. These efforts include initiatives to tap the potential of carbon nanotube (CNT) technology and design and deploy higher speed copper and fiber optic solutions. Even as steep budget cuts are being made, these efforts are expected to press on in laboratories, on test beds, and onboard aircraft.

The outlook for the wire and cable market segment remains positive with the notable exception of a couple of red flags. “The impact of austerity measures in Europe and the sequestration in the United States have been offset by growth in production, research and development in civil aerospace,” said Adrian Milne, civil aerospace product specialist at W.L. Gore & Associates.

Commercial aviation remains strong; major transport and business aircraft manufacturers, such as Boeing, Airbus and Gulfstream, have “got plenty of backlog,” said Bob Scott, senior wire and cable product manager at A.E. Petsche, an Arlington, Texas-based distributor of wire and cable products.

However, for the industry “cost is becoming more of an issue in purchasing decisions … (and) the industry is struggling with the issue of needing higher performance with higher data rates at a lower cost,” said Milne.

In addition, sequestration, while not generally felt now, will inevitably have an impact, especially on the military side, hitting even what might be called “almost sacred cow type programs … (including) possibly some very big ticket items that have already been pushed out in years past like F-35,” said Scott.

Already “more countries are extending the life of their current (military) fleet through Service Life Extension Programs (SLEP) through upgrades and retrofits rather than purchasing new aircraft,” said Dave Gioconda, military aerospace product specialist at Gore.

“We have seen some projects be delayed, downsized or outright converted to a completely internal government project to keep the dollars inside its departments,” said Michael Traskos, president of Lectromec, a wiring test company based in Dulles, Va. “Some maintenance and life extension assessments have been delayed leaving the aircraft to operate with an unknown level of risk.”

Traskos said, however, the company has almost completed a handbook related to assessing the safety of the electrical wiring interconnect systems (EWIS) related to SLEPs for the U.S. Air Force. “It will be integrated with the latest revision of the MIL-STD-1798 due out in the next couple of months,” he said, adding “there has been a great deal of interest in the handbook (from) a number of groups within the military.”

Meanwhile, the sequester cuts are likely to come largely at the expense of operations and maintenance programs rather than research and development (R&D) spending, said Jill Choi, global product manager for specialty high performance wire and cable at TE Connectivity. “If you look at history, R&D spending is, even in lean times, still pretty constant and I wouldn’t expect it to be cut” this time.

This should be good news for companies working on high speed, low weight wire and cable solutions, especially of CNTs. Still in its early stages, that effort already includes a growing roster of developers, such as Nanocomp, General Nano and Teijin Aramid, in addition to industry heavyweights TE Connectivity and Lockheed Martin.

|

Last year, PIC Wire & Cable introduced its DataMATES

product line of high-speed data cables, which offers

tailored systems for various airborne applications

including Ethernet Communications Backbone,

cabin management, in-flight entertainment, avionics

networks and high-definition video. |

Serving as a technology integrator, TE is “working with several suppliers… each has benefits and each has some limitations,” said Stefanie Harvey, principal scientist at TE Connectivity. They are all focusing on boosting conductivity in expanded use of CNTs; “we want to get as close to copper as we can.”

CNTs have exceptional aspect ratio “a nanometer and a half in diameter and … between 50 microns to 2 millimeters long” giving some “unique properties in terms of electrical (and) thermal conductivity,” Harvey said. For the aviation industry, their key attribute is the weight savings they could provide as a replacement for copper. “When we built an all carbon nanotube 1553B cable, (where) the only thing that wasn’t carbon nanotube was the dielectric and connectors, we got a 69 percent weight savings.”

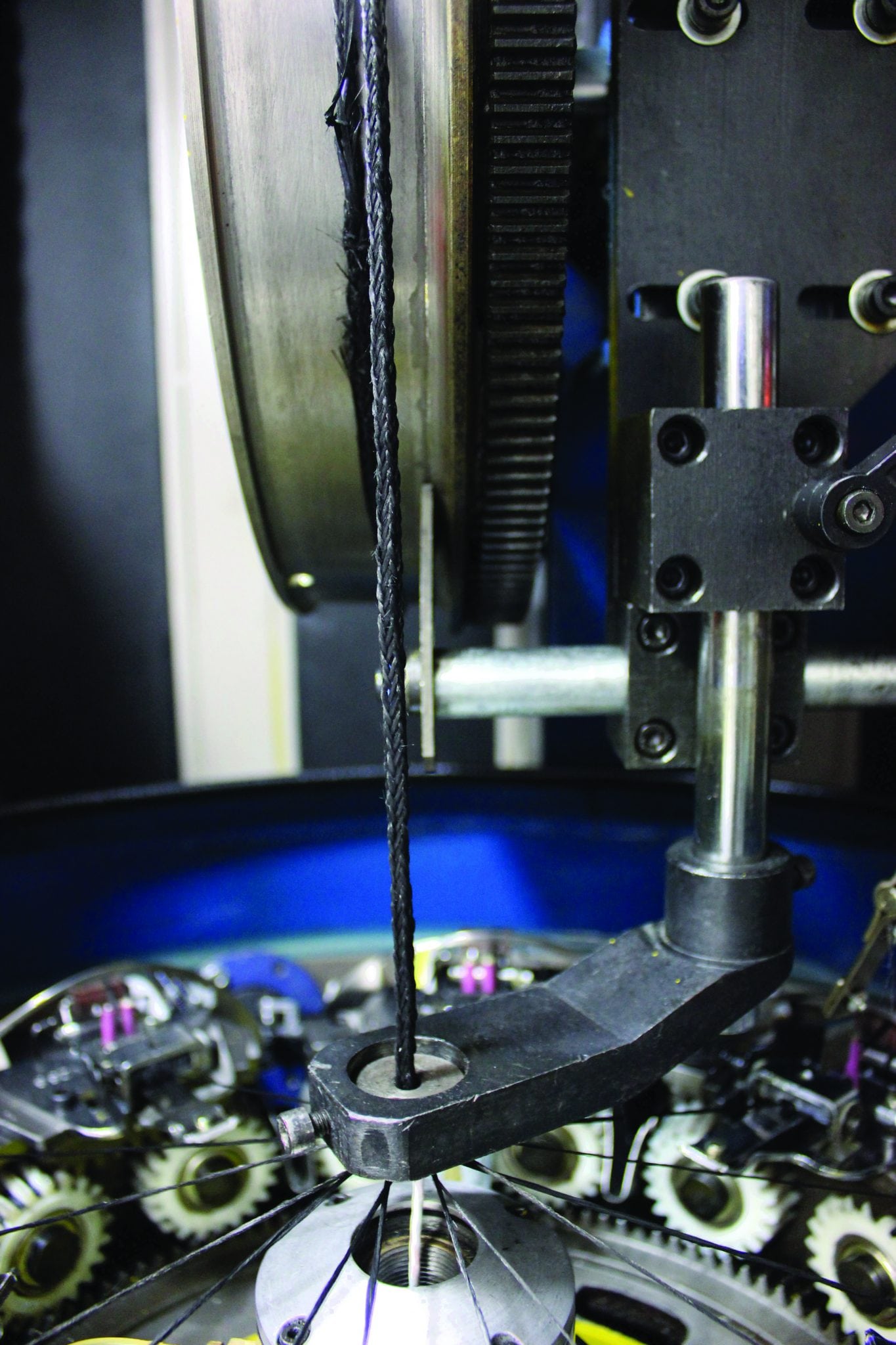

It also better than copper when it comes to “flexure fatigue, corrosion resistance and strength,” added Peter Kujawski, business development director at Nanocomp. Founded in 2004, the Merrimack, N.H.-based company has “produced a million and a half meters of CNT yarn … and are shipping kilometers of (cable) shield material yarn,” he said. The company is also working with Northrop Grumman under the U.S. Army Manufacturing Technology Program (ManTech) to develop manufacturing best practices for carbon nanotube cabling and tapes, intended for insertion into aircraft as a replacement for conventional copper-based wires and cables.

Despite all this potential, there are still difficult engineering hurdles to be cleared before it can come close to catching up with copper’s conductivity. The technology’s Achilles heel is that it loses conductivity when it is “grown” into larger or longer structures. In the sense the challenge is “we are taking something which has special properties in nano-scale and … trying to scale it up to the macro-scale,” Harvey said. Maintaining conductivity is “the big challenge” in this effort; it is “what really gets impacted when you put a whole lot of nanotubes together.”

Another challenge is getting production volume “because traditional wiring and cable toolsets run miles in a day, and (the question is) can these up-and-coming companies supply enough volume to keep a line going; then, if they can, is it going to be cost competitive?” Harvey asked.

Individual developers are exploring different approaches to the address these issues, and for now satellites and UAVs are providing “great first platforms for this technology because they’re small,” said Harvey.

“We have already been launched and have material still in space right now,” said Kujawski. For UAVs, the weight savings will allow the platform “to deploy a bigger payload or allow it to have longer loitering time.”

If it is not used to replace copper, the industry is exploring the use of CNTs with copper wire. “Active evaluation of CNT material in copper wiring is well underway and the early adopters are already testing the technology,” said Gioconda.

The main attribute again is weight. “In general if you replace only the shielding on wire harness … with carbon nanotubes you will get about a 30 percent weight savings,” Harvey said.

In the near term, industry is working on ways to boost the capacity and reduce the weight of the copper wire and cable that still resides in most of the nation’s aircraft. For example, TE Connectivity is “creating new and improved processes of foaming materials that give you better signal propagation,” said Choi. “Aerospace generally requires at least 200°C temperature rating now. Usually we use fluoropolymers, such as ETFE, but those require cross-linking, so what we do instead is use an FEP (fluorinated ethylene-propylene)-based polymer insulation and then we foam it … in such a way that we create very evenly dispersed fine bubbles which help in your signal propagation in your electrical integrity.”

However, the emergence of composite aircraft bodies has thrown a wrench into efforts to lighten copper wire. Unlike the metal structures, composites don’t serve as grounding mechanisms making copper wiring more vulnerable to lightning strikes “which means that now the wiring has to have additional shielding,” Choi said. “This is making fiber optics look pretty attractive … (because it doesn’t) have any EMI issues.”

The growing use of fiber optics, however, is primarily being driven by a “lot more requirements for high-speed data applications” on aircraft, said Paul Jortberg, vice president of business development at kSARIA, based in Methuen, Mass. On military aircraft these applications can be “new state-of-the-art radar and … HD type video capabilities.” In the commercial market, in-flight entertainment is “a big driver of the optical fiber with the bandwidth that is needed for those types of systems bringing bandwidth to the seat is kind of what they’re calling it,” said Tony Christopher, kSARIA’s vice president, technical operations.

This use of lightweight, more capable solutions, like fiber optics, is only going to grow as new aircraft models, such as the forthcoming Boeing 777X, not only deploy it but offer the main driver of its use expanded connectivity — to its passengers. “As consumers expect more access to electronics during flight, the industry is looking for lightweight, reliable solutions that provide continuous connectivity throughout the aircraft for the diverse range of consumer electronics,” said Brian Tallman, aerospace market leader at Gore. This means “more fiber optic cables are being used for data lines, and the industry (will demand) increased voltages in smaller, lighter-weight cables,” said Christopher Cox, new product development at Gore.

Furthermore, “we are seeing more Ka-Band antennas being installed because of the bandwidth that is available in this frequency range … (enabling) passengers to enjoy the same level of connectivity as they are accustomed to having on the ground.” Gore is facilitating this trend with its retrofit Leaky Feeder Antennas, which are compatible with numerous communication standards for a full range of electronic devices, said Milne. “Even with current restrictions around cell phone usage in U.S. airspace (FAA restrictions) … the Leaky Feeder Antennas can control cellular power levels within a cabin environment reducing any potential emissions risk.”

To meet the growing demand for connectivity, “we are starting to see more and more deployment of very high density fiber channels and interconnectivity of those high channels, and that interconnectivity does present challenges,” said Jortberg. This level of intricacy makes the service and support of “those connectors much more complex,” requiring “additional training for some of the folks that are out in the field doing that.”

In general, maintenance and termination issues remain the key reasons why fiber optics has “not taken hold quite yet,” said Scott. “It will happen (but) it is just going to be a long slow climb five or 10 more years.”

“Maintenance is still a nagging problem in the industry,” said kSARIA’s Christopher. “It is starting to get a little better … (but) there is a lot of training that needs to take place out there.” Meanwhile, “when something needs to be repaired or re-terminated … in the field, … it (often becomes) a remove and replacement operation.”

“When you work with fiber optics there are lots of different splices you can put on there, and the easiest by far is the fusion splice,” said Choi. “But that also (involves) a lot of heat; you are arcing and melting things, and (operators) really look down on using anything that hot when you are repairing an aircraft. So the industry want us to have a solution that is a mechanical-based splice that is easy to use,” she said.

For its part, kSARIA has recently “ developed some portable automated tools that can … aid in termination in the field for aircraft as well as other platforms,” said Christopher.

Meanwhile, there are ongoing initiatives and some new standards being crafted to offer guidance in addressing high-speed technology issues and fiber specifically, said Paul Prisaznuk, AEEC executive secretary and program director at ARINC. This year, ARINC announced a new standard ARINC 832 for the fourth generation cabin networks addressing the 1 Gigabit per second network. As soon as that is approved, “we are going to start work on supplement one which will introduce fiber in areas where it previously hadn’t been and … a 10 gigabit per second network,” he said. Regarding the fiber optics termination issues, AEEC has acted on requests to begin working on a new standard for expanded beam contacts. “I am anticipating the end of 2015 for new expanded beam contact definitions,” he said.

Essentially, a noncontact type of interface, the expanded beam approach has gained some industry support for at least use in particular applications. However, there are some skeptics. There are questions about issues such as the technology’s “large expense and the larger packet size, (so) I am not sure that really gets a foothold,” said Jortberg. “I would say from a reliability and maintenance standpoint, what is referred to as a PC, the more traditional style connector, are still widely used … (and) reliable, so long as you have trained personnel that service them they can last quite a long time.”

Next month: Sensor Payloads

Avionics Magazine’s Product Focus is a monthly feature that examines some of the latest trends in different market segments of the avionics industry. It does not represent a comprehensive survey of all companies and products in these markets. Product Focus Editor Ed McKenna can be contacted at [email protected].

Market Moves

The following are some news and product developments from manufacturers and distributors of aerospace wire and cable products.

â–¶ A.E. Petsche in January said it was relocating its assembly center in Arlington, Texas, to a 66,000-square-foot facility in Nogales, Mexico.

“The new facility will give us the ability to significantly increase production capacity, allow greater flexibility and provide scalability for future growth,” the company said in a letter to customers. All other value-added services such as, kitting, wire marking, cutting and striping will remain at its Arlington, Texas, facility.

â–¶ Carlisle Companies, based in Charlotte, N.C., last year paid $265 million to acquire the Thermax-Raydex business, a supplier of hook-up, data and coaxial wire and cable for mission-critical applications for commercial aerospace, defense and industrial customers. The Thermax-Raydex business, which was a unit of Belden, of St. Louis, Mo., designs, manufactures and sells customized wire and cable for transmission of data and power on aircraft and defense platforms, as well as in high-end industrial equipment. The business will operate as part of Carlisle Interconnect Technologies.

â–¶ Laura J. Mullen has been named president of Marine Air Supply, based in Frederick, Md. Mullen has been with Marine Air Supply since 1980, managing the Accounting and Export Compliance since 2003.