[Avionics Today 12-28-2015] Throughout 2015, commercial aviation has seen a global rise in air traffic and profitability, according to preliminary figures released on Dec. 22 by the International Civil Aviation Organization (ICAO). The global aviation organization released numbers that reflected a 6.4 percent worldwide increase in the total number of passengers carried on scheduled services over the last year.

|

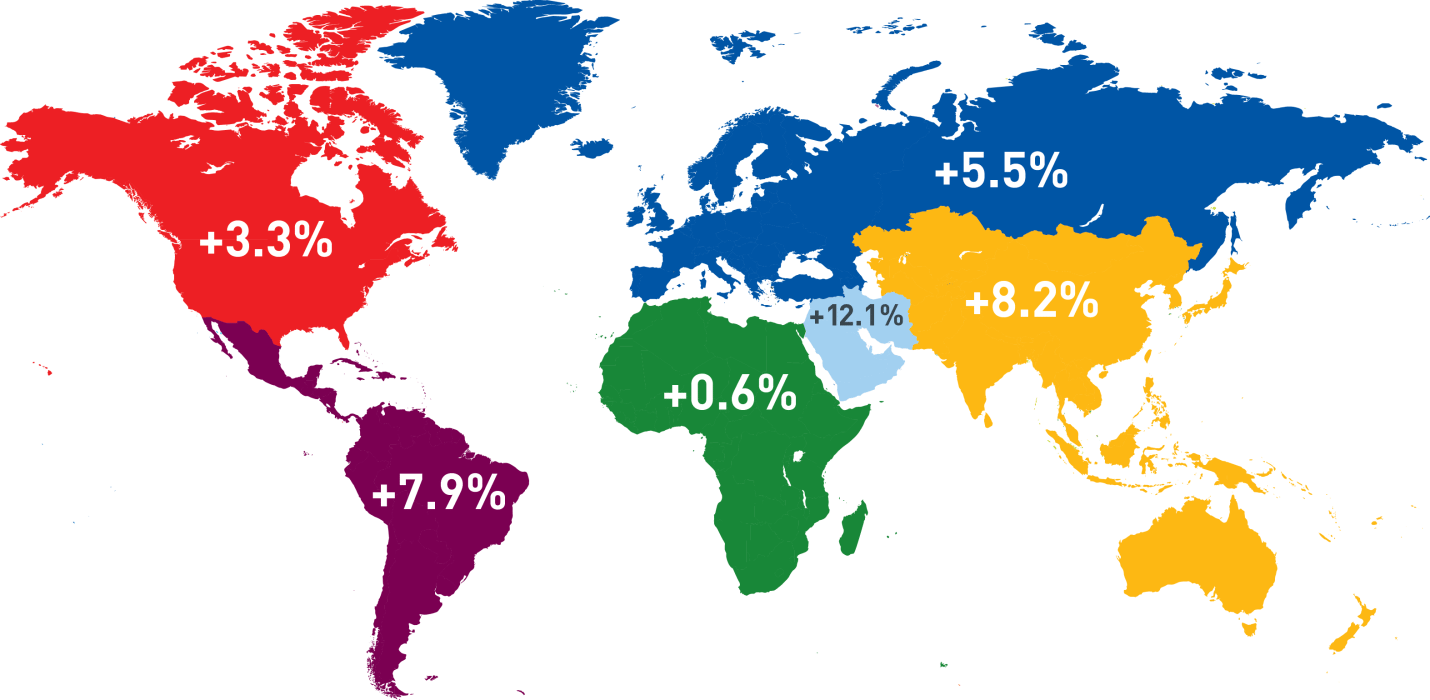

| ICAO map of 2015 air traffic increases. Photo: ICAO |

Despite sluggish economic growth in advanced economies and most emerging markets, air traffic still saw a boost in profitability thanks to a nearly 40 percent decline in the average 2015 jet fuel price. This gave air carriers a bit of wiggle room to lower airfares and help stimulate this increase, leading to a total airline operating profit of $60 billion in 2015, as opposed to $45 billion in 2014.

With 3.5 billion passengers flying on commercial aircraft this year and airlines generating record profits, the numbers differ sharply across the globe. Here’s how each region stacked up in 2015.

The Middle East

The Middle East saw the most growth over the last year, according to ICAO, with a 12.1 percent increase in 2015 compared to the year before. The region currently carries 14 percent of the world’s Revenue Passenger-Kilometers (RPKs), and this number is anticipated to grow. According to Boeing’s latest Current Market Outlook (CMO), released in November, airlines in the Middle East are forecasted to require 3,180 new airplanes over the next 20 years, with rapid fleet expansion in the region driving an estimated 70 percent of that demand.

“Traffic growth in the Middle East continues to grow at a healthy rate and is expected to grow 6.2 percent annually during the next 20 years,” said Randy Tinseth, vice president of marketing at Boeing Commercial Airplanes in a statement regarding Middle East’s projected growth. “About 80 percent of the world’s population lives within an eight-hour flight of the Arabian Gulf. This geographic position, coupled with diverse business strategies and investment in infrastructure is allowing carriers in the Middle East to aggregate traffic at their hubs and offer one-stop service between many city pairs that would not otherwise enjoy such direct itineraries.”

The Asia-Pacific

Despite recent economic volatility, China is the poster child for growth in the aviation industry and — alongside growth in India — has much to do with the 8.2 percent bump in air traffic enjoyed by the Asia-Pacific region in 2015. Domestically, the region saw an even larger increase, marking growth of 10.3 percent in domestic air traffic, according to ICAO, and accounting for 39 percent of world domestic scheduled traffic.

Low Cost Carriers (LCC) are contributing full sail to this upturn, with LCCs in the Asia Pacific representing 31 percent of total LCC passengers carried worldwide, according to ICAO. These low-cost options coupled with the dropping price of airfare, which has come down roughly 48 percent since 1990, are catering to the country’s rising middle class.

“Travelling is cheaper and is becoming more ubiquitous and more available, especially as the wealth rises in upcoming populations,” Tom Captain, vice chairman and U.S. aerospace and defense leader for Deloitte, told Avionics Magazine in an earlier interview. “It’s probably a good bet that the continued growth of air travel will exceed global [Gross Domestic Product] GDP by a factor of 40 to 50 percent.”

Latin America

Carriers in Latin America and the Caribbean managed four percent of world RPK traffic and recorded 7.9 percent growth in 2015. Current and future growth is hampered by economic difficulties across the continent, however, spurred by an economic downturn in Brazil.

“The deepening recession in Brazil is dragging down the industry across the continent,” Tony Tyler, director general and CEO of International Air Transportation Association (IATA) remarked during Global Media Day in Geneva earlier this month. “Earlier this year we projected that Latin American airlines would make a $600 million profit and now we see a $300 million loss in 2015. The situation is being made worse by government policies, which inflate fuel prices and other critical infrastructure costs.”

Europe

Europe accounts for the largest share of international RPKs at 37 percent and enjoyed an increase of 5.5 percent over 2014 numbers this year. With aviation sitting as an important pillar to the European economy, the European Commission also recently announced its adoption of a new aviation strategy for Europe: an initiative to boost the continent’s economy, strengthen its industrial base and reinforce its global leadership position. This plan aims to build on the success of the current industry, which is appreciating a 6.9 percent jump in profits according to IATA’s latest year-end report.

“Breakeven load factors are highest in Europe, caused by low yields due to the competitive open aviation area, and high regulatory costs,” said Brian Pierce, IATA’s chief economist and director said in IATA’s year-end economic report released Dec. 10. “Net profits are forecast to rise to $8.5 billion next year.”

IATA’s Tyler calls for Europe to look ahead, however, and spur further development with the increased implementation of Single European Sky.

North America

North America recorded 3.3 percent growth in 2015. The region is also home to the world’s largest domestic market with 43 percent share of the world domestic scheduled traffic. Moreover, the aviation industry experienced around 4.7 percent growth in 2015, spurred largely by the popularity of by LCCs in the region.

While North American aviation represented just 14 percent RPK share in 2015, the region’s carriers generated more than a third of world airline profits. Looking forward to 2016, a further decline expected in oil prices, coupled with an improving economic scenario, should see passenger traffic and profits continue their upward trend both in the region and worldwide.

Africa

Africa is the weakest region for air traffic, as it stands today and, most likely, going into next year. African air traffic grew at a rate of 0.6 percent in 2015, according to ICAO, but a recent IATA report finds that African carriers may have seen a loss of an estimated $300 million this year.

“Breakeven load factors are relatively low, as yields are a little higher than average and costs are lower. However, few airlines in the region are able to achieve adequate load factors, which average the lowest globally at 56 percent in 2015 and 2016,” said IATA’s Pierce in the organization’s year-end report.

While Pierce notes that “performance is improving, but slowly,” 2016 doesn’t look much better for the continent, with IATA predicting collective losses of approximately $100 million for carriers in the region next year.