[Avionics Magazine 10-31-2016] Honeywell’s annual Global Business Aviation Outlook forecasts deliveries of approximately 650 to 675 new jets in 2016, a low- to mid-single-digit percentage decline year-over-year as order rates for mature models slow and fractional-usage type of aircraft deliveries stabilizes. Between 2016 to 2026, the report forecasts up to 8,600 new business jet deliveries worth $255 billion, which represents a 6 to 7 percent reduction from the values noted in the 2015 forecast.

|

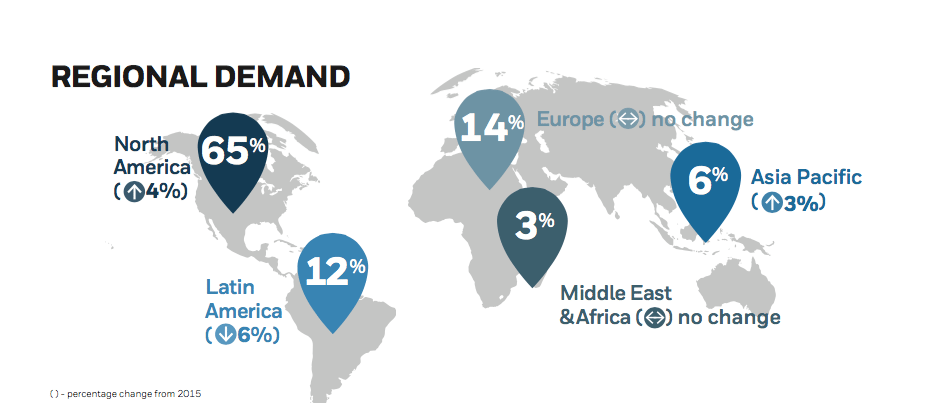

| Chart of regional demand for business jet deliveries. Photo; Honeywell |

The business aviation industry continues to face a slow near-term pace of orders due to a slow-growth economic environment across many global markets along with many political uncertainties, according to the 25th annual report.

“We continue to see relatively slow economic growth projections in many mature business jet markets. While developed economies are generally faring better, commodities demand, foreign exchange and political uncertainties remain as concerns,” said Brian Sill, president of commercial aviation at Honeywell Aerospace. “These factors continue to affect near- term purchases, but the survey responses this year indicate there is improved interest in new aircraft acquisition in the medium term, particularly in the 2018 to 2019 period. In the meantime, operators we surveyed this year indicated plans to increase usage of current aircraft modestly in the next 12 months, providing some welcome momentum to aftermarket activity, which has been flat recently.”