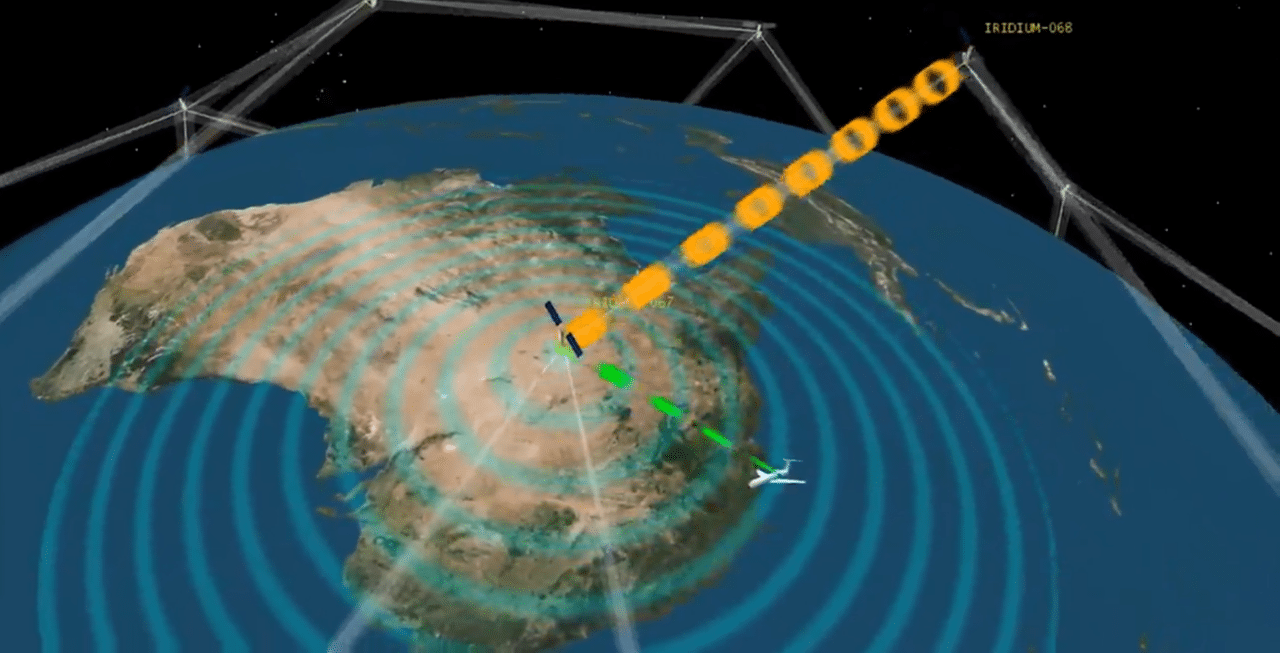

Flyht’s AFIRS hardware sales saw the biggest revenue growth in the third quarter, up 15% YOY. Image courtesy of Flyht

In the wake of the company’s October acquisition of Panasonic Weather Solutions (PWS), Flyht’s third-quarter earnings are in line with recent quarters and years: $3.1 million in total revenue, down 4 percent year over year. The fourth quarter is when the PWS acquisition will really start to shake things up, CEO Tom Schmutz said in a Thursday earnings call.

In addition to having a full quarter for the acquisition of contracts to take effect, the first third of the $3.3 million subsidy Panasonic will pay Flyht as part of the agreement will happen in that quarter, significantly boosting Flyht’s revenues. At the same time, Flyht will start seeing the returns on a $2 million-per-year contract with the National Oceanic and Atmospheric Administration that it will take over from PWS. In the past several quarters, Schmutz said, revenues have held steady at just above $3 million, so the $1.6 million stimulus will represent a notable shakeup.

The company’s biggest segment, automated flight information reporting system (AFIRS) hardware sales, saw a 2 percent year-over-year decrease in revenues in the third quarter to $1.7 million. That comes from 18 installation kits compared to 23 in 2017’s third quarter. Schmutz said that going forward, this segment would be renamed and expanded to general hardware sales because of additional offerings resulting from the PWS purchase. Additionally, the expanded portfolio granted by the acquisition should allow bundling that will help with AFIRS sales, according to Schmutz.

“Will we be able to increase cross-selling across two customer bases? The answer, I think, is yes,” Schmutz said. “Some of the operators that Panasonic was pursuing, Flyht was also pursuing, and I believe we’ll be able to close on some of those with hybrid offerings.”

Software as a service, Flyht’s second most profitable business segment, saw revenues of $1.1 million in the third quarter, which represents a annual growth of 11 percent. The company’s as yet unrevealed Chinese launch customer for the service, Flyht recently announced, added a five-year, $1.1 contract for the company’s aircraft health monitoring service, FLYHTHealth, on top of the similarly valued deal it already had for FLYHTLog.

Looking forward to the end of 2018, 2019 and 2020, when the transition period of the PWS acquisition closes, Schmutz indicated that Flyht is focused on its place in the distress tracking world and its footprint in China.

Schmutz pointed to a Boeing-Embraer white paper validating the company’s flight tracking and data streaming solutions. Used in conjunction with Inmarsat’s SwiftBroadband, the testing found that the currently available solutions would meet ICAO’s 2021 GADSS requirements. Given that Flyht already has STCs for 95 percent of commercial aircraft, Schmutz predicted that those results would be “very positive for future revenues.”

In China, where Flyht currently has 23 of 57 operators, the goal is to land big fish.

“We’ve won … smaller to mid-sized airlines,” Shmutz said. “We’re working on mid-sized to larger airlines. Those take a little bit longer to close. 2019 should be much stronger Chinese performance than 2018.”

That pursuit should be aided by the PWS acquisition, not only because of an expanded portfolio and additional cash reserves but also because Flyht has eliminated a competitor.

“We had seen [PWS] in the marketplace in the past and competed with them for accounts like Air Asia, and those accounts transfer to us. We also gain that large operator,” Schmutz said, referring to one of the most significant contracts Flyht gains with the acquisition. “It also definitely improves our scale and allows us with economies of scale to better serve the market.”

The reason Panasonic Avionics was eager enough to pay Flyht to take its weather business was it had been losing the company money. Flyht, however, is confident that it will make money off the acquisition. It has a stated goal of being cash-neutral by the end of the 18-month acquisition period. As such, 2019 will be a year of big changes for the company.