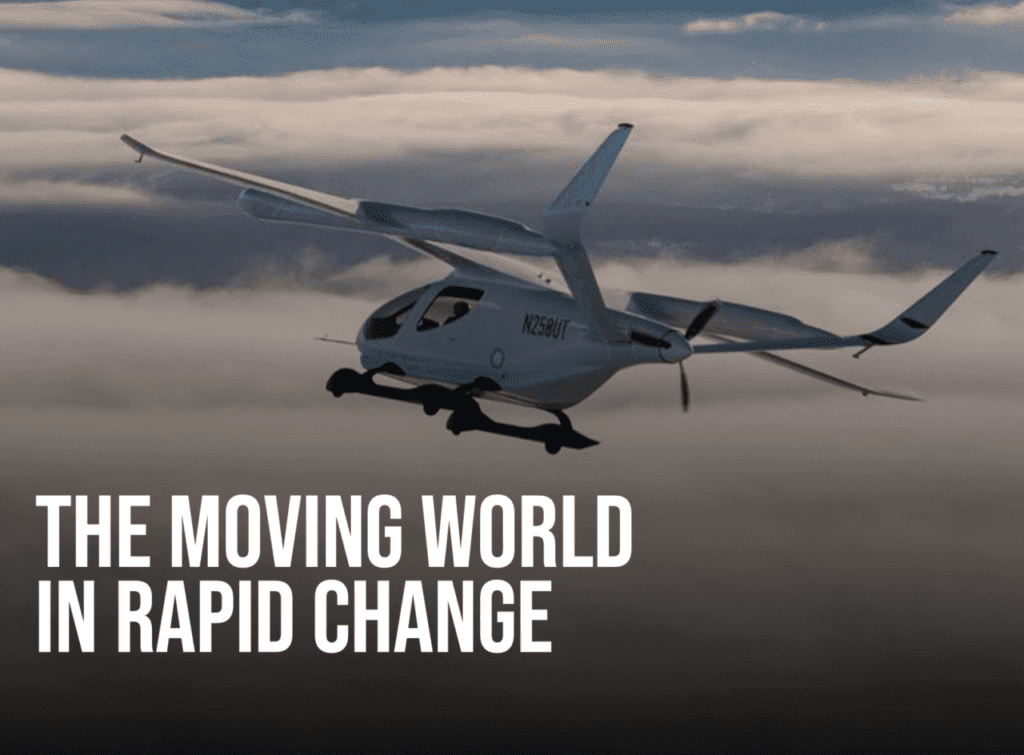

Macro and micro trends in mobility for the year ahead are explored in a new report from UP.Partners. “Unlocking the next wave of opportunities will require disruptive innovation in multiple dimensions of technology, infrastructure, supply chain, and human resources.” (Photo: UP.Partners)

The investment firm UP.Partners just released a report detailing current micro and macro trends in mobility. The “Moving World Report” explores the rapid progress in innovation for the transportation industry. It also analyzes some of the future opportunities for the industry, such as hypersonic flight, a circular economy for lithium-ion batteries, and lunar exploration.

Cyrus Sigari, co-founder and Managing Partner of UP.Partners, remarked in a statement, “Technology is disrupting aviation, [and] EV adoption is accelerating at rapid pace. Yet, the mobility sector has emerged as the largest CO2 contributor in the U.S. As many opportunities as there are in this rapidly transforming industry, there are even more challenges to be addressed.”

Global greenhouse gas emissions related to transport are likely to increase by another 11% by 2030 unless certain actions are taken. (Photo: UP.Partners)

Sigari continued, “Transforming the moving world by moving people and goods cleaner, faster, safer, and at lower costs is a shared mission among governments, investors, and entrepreneurs alike. It is our hope that industry leaders and their teams will use the Moving World Report as a guide to confront the challenges and unlock the opportunities that lie ahead.”

The report claims that global greenhouse gas emissions related to transport are likely to increase by another 11% by 2030—unless governments take decisive action on climate change initiatives. Aggressive innovation practices from industry leaders are also needed in order to reduce emissions and to achieve net zero emissions by 2050.

Progress and innovation in transportation has been driven by over $475 billion in venture capital funding for mobility startups over the past 10 years. “Mobility has been one of the fastest growing tech segments across the Venture Capital landscape over the past decade—a strong indicator of the accelerating innovation dynamics driven forward by startups shaping the future of the moving world,” the report states.

“Mobility has been one of the fastest growing tech segments across the Venture Capital landscape over the past decade.” (Photo: UP.Partners)

Since 2020, a majority of venture capital funding has gone towards last-mile delivery, electric vehicles, and autonomous driving. Advanced air mobility startups have received 5% of all venture capital funding for the larger mobility sector (since 2020), according to the report from UP.Partners.

The authors of the report also state, “Early-stage startup companies in mobility have remained resilient. In terms of the type of early-stage mobility firms that look the most promising, startup companies with a so-called ‘hardware-as-a- service’ (HaaS) model appear to be the hidden winners of the past year.

“HaaS mobility firms—those providing hardware, software, maintenance, and other services in one package for a monthly (recurring) fee—have seen their average first-time VC deal tickets jump to $10.5 million USD in 2022.”

These conclusions are based on analysis by UP.Partners using data from Silicon Valley Bank and PitchBook Data Inc.

The report outlines six major technological trends that are disrupting the aviation industry. These include electric aircraft, hydrogen aircraft, autonomous flight, eVTOLs, sustainable aviation fuel, and cargo drones. For the eVTOL (electric vertical take-off and landing) sector, the ten most-funded companies are Archer, Volocopter, Joby, XPENG, Lilium, BETA, Eve, Vertical Aerospace, Blade, and EHang.

Some of the leaders in the eVTOL industry, according to analysis based on information collected from PitchBook Data Inc. and press (Photo: UP.Partners)

“As the length of cruising range increases—meaning they can fly longer distances—eVTOLs become increasingly more energy efficient than their automobile counterparts,” the report claims.

Innovations in autonomous flight technology have been gaining momentum. The pilot shortage that the commercial airline industry is experiencing underscores the need for developing advanced technology that is autonomous.