“We began 2022 in arguably the strongest position business aviation had ever been in, activity wise, but we ended 2022 with some of the first activity losses since the pandemic began to loosen its grip on air travel.” (Photo: Argus)

Argus International recently released its 2022 North American Business Aviation Review. Argus is a leader in creating technology to provide aviation services and insights that enable better business and operational decisions. In its new report, the company presents data and statistics that provide insight into current trends in business aviation.

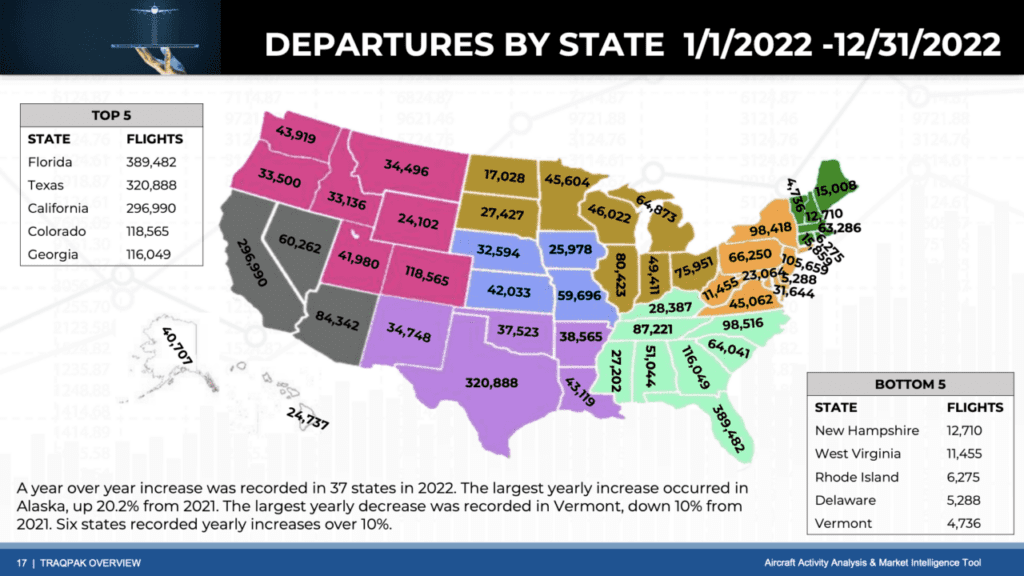

Overall, despite several years of disruptions, it seems that business aviation is growing again. Total flight activity in 2022 increased by 15.5% from 2019 levels and 5.1% from 2021 levels. Furthermore, total flight hours also increased by 22.1% from 2019 and 10.6% from 2021 levels. More flights and flight hours demonstrate not just the industry’s comeback from the pandemic, but further growth beyond pre-pandemic levels.

Argus also analyzed specific flight categories to determine which types of travel were responsible for the industry segment’s growth. Compared to 2021 volumes, Part 91 operations (which are essentially non-commercial operations with fewer regulations) saw both an increase in flights and total hours, with 7.9% and 10% growth respectively. Meanwhile, Part 135 flights (mainly commercial operations, like charter flights) have also seen increases in both the number of flights and total flight hours, seeing 1.3% and 4.9% respectively relative to 2021 levels. In total, 2022 saw 2,116,021 hours of Part 135 operations, a significant increase of 99,757 hours from 2021’s and 786,292 hours from 2020’s levels.

Several of the largest operators are responsible for a significant portion of the total flights. NetJets, a private business jet company, accounted for the largest amount of the flights. With the largest fleet of private jets in the world, the company had 511,224 flight hours in 2022. The next largest operator, FlexJet, was a distant second place in terms of flight hours. It clocked in at 183,548 hours in flying—64% less than NetJets. Wheels Up, Executive Jet Management, and Solairus Aviation are the third, fourth, and fifth largest companies respectively, each flying only a fraction of NetJet’s hours.

The busiest airport for business travel in 2022 was Teterboro Airport (TEB), which saw 73,564 departures last year. This figure was up 17.6% from 2021 levels. Teterboro Airport is located just west of New York City in northern New Jersey, making it a convenient gateway to one of the country’s largest economic hubs. Following Teterboro are West Palm Beach (PBI), Dallas-Love Field (DAL), White Plains (HPN), Van Nuys (VNY), Las Vegas (LAS), and Centennial Airport (APA) near Denver.

In 2022, despite significant recovery, the business aviation industry still faces several trends that present obstacles to its growth. The industry is still struggling to acquire and retain personnel. Furthermore, some international requirements continue to change, which could adversely impact operations. Beyond personnel and legal challenges, business aviation companies must also focus on retaining customers won over from airlines.

Looking ahead to 2023, Argus believes there are four main areas that will impact the industry: challenges with personnel, supply chain issues, changes with Part 91 flying, and the possibility of a global recession. While Argus admits that measuring personnel and supply chain issues is difficult, things like more relaxed international regulations could bolster Part 91 flying even as it faces a potential global recession.