Leisure travel has rebounded to pre-pandemic levels, but the recovery of corporate travel has been slower due to various factors. Deloitte recently released its 2023 Corporate Travel report titled “Navigating Toward a New Normal.” The report, based on a survey of 334 executives with travel budget oversight from the United States and Europe, reveals that although corporate travel is beginning to take off, a full recovery is not expected this year. Companies are cautious as they prioritize cost and sustainability goals, resulting in a projection of corporate travel spend remaining smaller than pre-pandemic levels. Deloitte’s report includes a projected timeline for recovery and analysis of the shifting dynamics in travel priorities.

Some of the key findings from the 2023 Corporate Travel report:

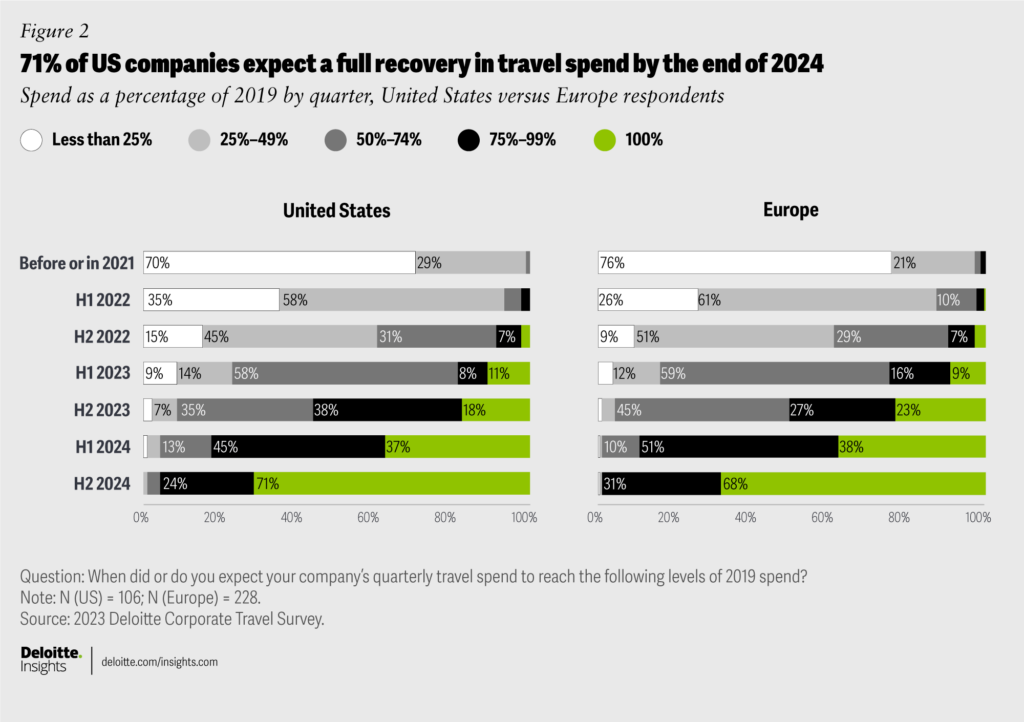

Corporate travel’s rebound is on similar trajectories in the United States and Europe. Spend in the combined markets is projected to surpass half of 2019 levels in the first half of 2023, and two-thirds by the end of the year.

While full recovery to 2019 spend volume appears likely by late 2024 or early 2025, adjusting for lost growth and inflation indicates that in real terms, corporate travel will likely be smaller than it was prior to the pandemic.

International trips continue to grow, as challenges decline for visiting parts of the world. US respondents expect international’s share of travel costs to jump from 21% in 2022 to 33% in 2023. European respondents expect 32% of 2023 spend to go to international trips within the continent, and 28% beyond.

Expected recovery in travel spending (Photo: Deloitte)

Eileen Crowley, who leads Deloitte & Touche LLP’s US Audit & Assurance Transportation, Hospitality & Services practice, offered further insights into the report in a recent interview with Avionics International. She underscored that, although the respondents don’t expect a full recovery of corporate travel to pre-pandemic levels this year, most do foresee a recovery by the end of 2024.

“There’s a lot of other factors that companies, CFOs, and CEOs are considering as it relates to the cost benefit of travel and the return on investment for outlining those travel dollars,” Crowley explained. One factor that may have contributed to a slower recovery for business travel is the use of technology to replace the need to travel, in many cases. Internal meetings are a prime example of where companies may opt to set up a virtual meeting rather than pay for the costs of travel.

In comparison, corporate travel for events like live conferences—which enable the development of client relationships—remain important. If travel results in revenue-generating new relationships, Crowley said, “those are trips that people are going to take, based on what we’re hearing from our survey responses.”

She noted that another interesting finding from their survey was an increase in travel to companies’ headquarters compared to before the pandemic. Previously, most employees were centered around the corporate headquarters and would travel out to meet clients. Now, with more fully remote employees and greater workplace flexibility, it’s more common to have them travel to the office.

Predictions for corporate travel spending in the first half of 2023 (Photo: Deloitte)

Sustainability is also a key factor in trends related to business travel. Many companies have introduced initiatives to reduce their impact on the environment and have set sustainability targets for 2030, 2040, and beyond.

“We are seeing that companies are starting to try and gather more data from their vendors about what impacts to the environment a trip may have, whether it’s carbon emissions or electric rental cars,” Crowley remarked. “What we’re not seeing yet is the cost that they’re willing to pay for sustainable products. They’re not necessarily curbing travel because of sustainability. They may be curbing travel because of cost or technology.”

Essentially, it’s becoming more important for companies to have the necessary data to be prepared to reach their sustainability goals and mitigate their environmental impact. “42% of companies in the U.S. are implementing strategies to assign carbon emissions to a team’s budget,” she noted.

“I think they’re trying to prepare themselves to have enough information to share with their organization internally, to make the best decisions that contribute to hitting their targets that they have announced.”

Another report published earlier this year by international aircraft leasing company Avolon predicts that global air traffic will return to pre-pandemic levels by June. And, according to Argus International’s 2022 North American Business Aviation Review, business aviation is growing again despite numerous disruptions. Total flight activity increased by 15.5% in 2022 compared to 2019 levels, and increased by 5.1% compared to 2021 levels.