Global Avionics Round-Up from Aircraft Value News (AVN)

The growing challenge of avionics sophistication is affecting MRO demand, aircraft readiness, and airline profitability.

The backlog of avionics maintenance, repair and overhaul (MRO) work is growing, with direct consequences for aircraft readiness and airline profitability. Furthermore, the MRO burden is having a ripple effect on aircraft base values and lease rates, altering the financial dynamics of the aviation market.

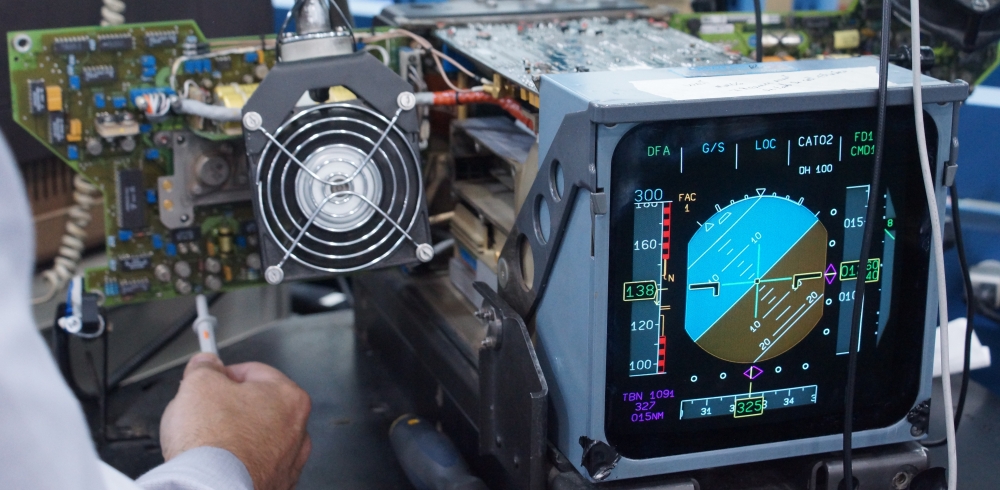

From flight management systems to navigation and communication devices, avionics have become more sophisticated, enhancing the capabilities of aircraft. However, these advancements are increasingly wreaking an unintended consequence—higher maintenance demands.

As avionics systems grow more intricate, MRO work is becoming more intensive, leading to longer turnaround times, a backlog of MRO tasks, and consequentially, diminished aircraft readiness and profitability for airlines.

Avionics systems today are designed to handle an unprecedented level of automation and data management, which has improved flight safety, fuel efficiency, and real-time diagnostics. However, the complexity of these systems necessitates specialized maintenance.

In the past, legacy avionics systems could be maintained and repaired by general engineers with a broad skillset. However, today’s modern avionics demand highly trained technicians with expertise in both hardware and software. Industry analysts predict that the MRO crunch for avionics will only worsen in 2025, as the global economy gains traction and airlines expand.

Increasingly, advanced avionics systems rely on software updates, complex diagnostics, and even artificial intelligence to predict and prevent system failures. This push toward digitalization, while beneficial in many respects, has also made these systems more susceptible to issues that require precise calibration, sensor replacement, or software debugging.

The frequency of such maintenance tasks has risen significantly, and so too have the downtime and costs associated with them.

Unlike the past, where mechanical issues could be resolved relatively quickly, modern avionics problems often require diagnostic time, spare parts that are more challenging to source, and specialized technicians to solve them.

Global MRO networks are feeling the pressure, as they struggle to keep up with demand. This is especially pronounced in regions experiencing high aviation growth, such as the Asia-Pacific and Middle Eastern markets. While airlines are investing in modern fleets to stay competitive, they are increasingly finding their aircraft grounded for longer periods due to avionics-related maintenance work.

Aircraft downtime due to avionics MRO work directly affects airline readiness and profitability. In an industry where aircraft are revenue-generating assets only when in operation, extended time on the ground due to maintenance delays can translate into significant revenue losses. Airline schedules become disrupted, leading to customer dissatisfaction, missed flight connections, and in extreme cases, penalties from airport authorities for delays or canceled flights.

Moreover, as airlines face operational challenges from MRO backlogs, they are often forced to adjust their fleet management strategies, increasing spare aircraft capacity or even “wet leasing” additional planes to meet demand. These measures add to operational costs, further squeezing airline profitability margins. (Under a wet leasing arrangement, the owner supplies the aircraft as well as at least one crew member.)

The avionics MRO backlog is not just an operational issue for airlines; it also has significant financial implications for aircraft lessors and owners. Aircraft base values and lease rates are intricately tied to an aircraft’s availability, condition, and future performance expectations. When avionics maintenance demands increase, leading to extended downtime and higher costs, the residual values of aircraft are adversely affected.

Aircraft with ultra-sophisticated avionics systems are often valued higher because of their advanced capabilities, efficiency, and long-term operational potential. However, if maintaining these advanced avionics becomes too burdensome, the financial attractiveness of these aircraft can be called into question. Potential buyers or lessees may factor in the cost and frequency of avionics MRO when considering a purchase or lease agreement, leading to downward pressure on base values.

Lease rates, in particular, are sensitive to maintenance burdens. Lessors often pass on MRO costs to lessees via maintenance reserves or higher lease rates to hedge against future avionics-related expenses.

However, when MRO work becomes unpredictable and backlogs worsen, lessees become reluctant to commit to long-term leases for fear of incurring excessive maintenance costs, particularly if avionics MRO facilities are overwhelmed. As a result, lessors are forced to adjust their pricing strategies, creating downward pressure on lease rates to make their aircraft more attractive in the marketplace.

This article also appears in the October 21 issue of our partner publication Aircraft Value News.

John Persinos is the editor-in-chief of Aircraft Value News. You can reach John at: [email protected]